Tata Motors, the iconic Indian automobile manufacturer, has been a mainstay on the country’s roads for over seven decades. From humble beginnings, it has transformed into a diversified giant, straddling commercial vehicles, passenger cars, and even electric vehicles. But how has this translated into its stock performance? And what does the future hold for Tata Motors’ share price?

Riding the Growth Wave

Over the past year, The share price has seen a remarkable surge, appreciating by over 75%. This upswing can be attributed to several factors:

- Booming commercial vehicle segment: The Indian commercial vehicle market is expected to grow at a healthy CAGR of 12-14% over the next few years, driven by infrastructure development, e-commerce, and rural demand. Tata Motors, with its dominant market share in this segment, is well-positioned to capitalize on this growth.

- Passenger car segment revival: The Indian passenger vehicle market is also showing signs of recovery, with Tata Motors witnessing a strong demand for its new launches like Nexon and Punch. The company’s focus on SUVs, a popular segment in India, is also paying dividends.

- EV push: Tata Motors is at the forefront of India’s electric vehicle revolution, with a comprehensive lineup of electric cars and buses. The government’s push for EV adoption further strengthens the company’s prospects in this nascent segment.

Tata Motors Potential Growth and Target Prices

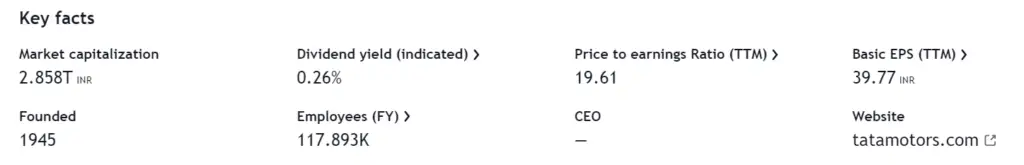

Analysts are bullish on Tata Motors’ future, with several predicting further upside for the stock. Some brokerage firms have set target prices as high as Rs 900-1000 per share, representing a potential gain of 15-20% from current levels. This optimism stems from the factors mentioned above, along with expectations of improved margins and cost control measures.

Overbought concern

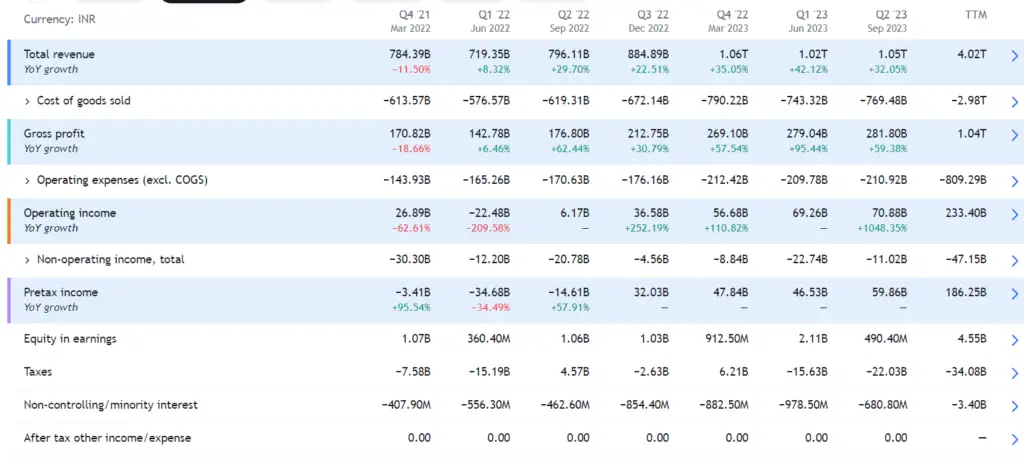

However, a word of caution is warranted. The recent surge in Tata Motors’ share price has pushed its valuation to relatively high levels. The stock’s price-to-earnings (P/E) ratio is now above the industry average, and some analysts believe it may be due for a correction. Additionally, rising interest rates and global economic uncertainties could pose headwinds for the auto sector

Technical Indicators

From a technical analysis standpoint, Tata Motors’ stock appears to be in overbought territory. The Relative Strength Index (RSI) is above 70, which suggests that the stock may be due for a pullback. However, the moving average convergence divergence (MACD) indicator is still positive, indicating continued upward momentum.

Potential for Growth

Tata Motors, with its diverse portfolio of automotive offerings, is positioned for significant growth in the coming quarters. Several factors contribute to this optimistic outlook:

- Strategic Expansion: Tata Motors has been strategically expanding its presence in key global markets. The company’s focus on electric vehicles, sustainable practices, and technological innovation positions it favorably in the evolving automotive landscape.

- Revival in Demand: As global economies recover from the impacts of the pandemic, there is an anticipated revival in demand for automobiles. Tata Motors, with its innovative and eco-friendly offerings, is well-poised to capitalize on this uptick in consumer spending.

- Financial Restructuring: The company’s efforts in financial restructuring, coupled with cost optimization measures, are expected to positively impact its bottom line. This financial prudence contributes to the overall attractiveness of Tata Motors as an investment option.

Conclusion

Tata Motors presents a compelling investment opportunity, driven by strong growth prospects in its core segments and its foray into the promising EV market. However, investors should be mindful of the potential for a correction in the near term and adopt a cautious approach. Careful analysis of both fundamentals and technical indicators will be crucial in navigating Tata Motors’ future trajectory.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Please consult a qualified financial advisor before making any investment decisions.