Introduction

The year 2024 is poised to be a crucial one for the Indian stock market, with investors closely monitoring the political landscape and its potential impact on market dynamics. One of the key indices under scrutiny is the Nifty 50, a barometer of the Indian equity markets. In this article, we delve into the possibilities and challenges surrounding the question: Can Nifty hit 30,000 in 2024, and how might the impending elections influence this trajectory?

Nifty Expert Analysis

According to a recent article by Mint, some experts believe that the Nifty 50 could touch the levels of 24,000-25,000 by the General Elections 2024 1. However, it’s important to note that the market is highly volatile and unpredictable, and there are several factors that could impact the Nifty 50’s performance.

One of the key factors that could influence the Nifty 50’s performance is the outcome of the General Elections 2024. As per Mint, the market hopes for a stable government after the 2024 elections, which could lead to a pre-election rally and a spike in the Nifty 50 index 2.

Market Optimism in Election Years:

The election years of the past have often been marked by increased market activity, and gains sometimes very considerable. As political stability is taken as encouraging economic development, many investors are optimistic. But the extent of market influence may change depending on election results, policymaking and global economic considerations.

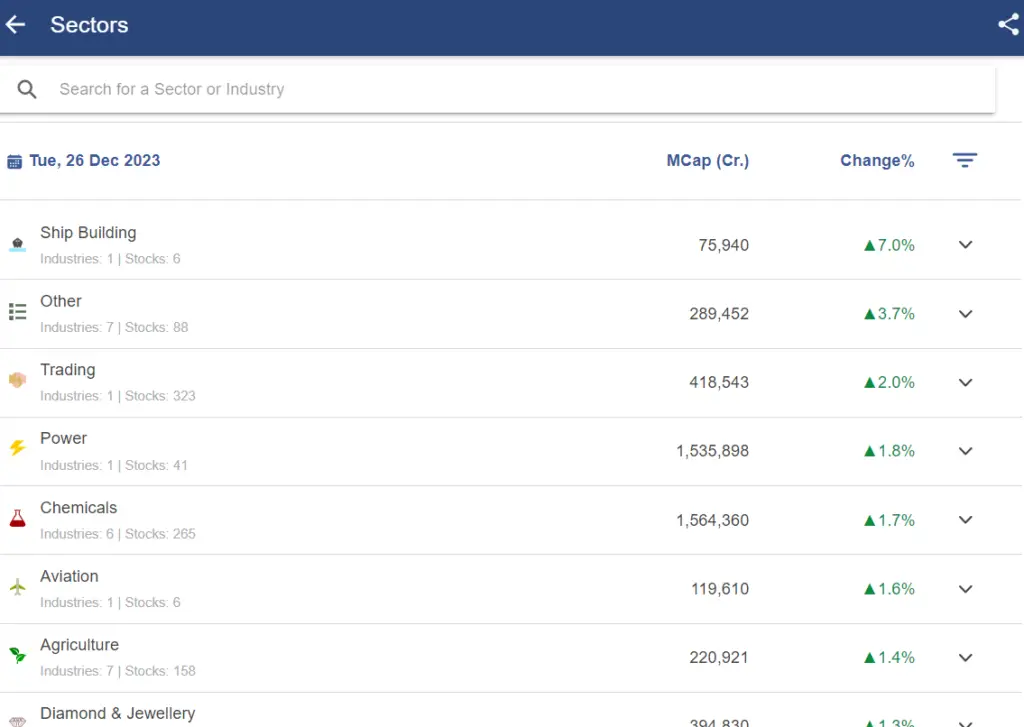

Sector in focus

- Construction

- Power

- Ship Building

Election-Driven Volatility:

Elections, by their very nature, introduce an element of uncertainty. Market participants tend to react to political developments, and this can result in short-term volatility. It’s essential for investors to stay vigilant and agile in response to political events that may influence market sentiment.

Global Factors and Market Trends:

While elections are a significant factor, global economic conditions and trends also exert considerable influence on the Indian stock market. Investors should keep an eye on international developments, trade relations, and geopolitical events that may impact market behavior.

Risk Mitigation Strategies:

As the market faces uncertainties, it becomes imperative for investors to adopt risk mitigation strategies. Diversification, a well-balanced portfolio, and a keen understanding of one’s risk tolerance are essential components of a robust investment approach in volatile times.

Nifty on Monthly Graph

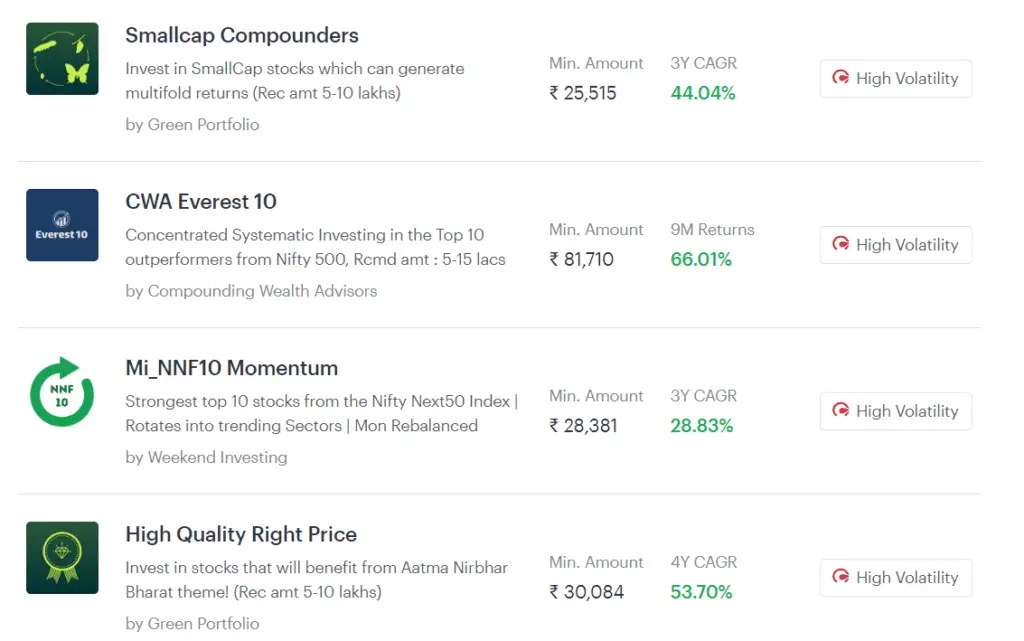

Discover Some focused smallcase

Bullish sentiment

- Economic Recovery: India’s GDP is projected to grow at a healthy clip of 7.5% in 2024, driven by factors like infrastructure spending, rural demand, and a rebound in the service sector. This bodes well for corporate earnings and investor confidence.

- Corporate Performance: Many Indian companies have adapted well to the post-pandemic landscape and are delivering strong financial results. This, coupled with continued reforms and policy initiatives, could further fuel the market rally.

- Global Liquidity: Despite rising interest rates in developed economies, India is still seen as a relatively attractive investment destination due to its higher growth potential. This could lead to continued foreign inflows into the stock market.

Beyond the Ballot Box: Economic Fundamentals Matter

While the elections will undoubtedly play a role, the Nifty’s journey to 30,000 hinges on other crucial factors like:

- Global economic headwinds: The ongoing war in Ukraine, rising inflation, and potential recessionary fears in major economies could dampen global market sentiment, impacting India as well.

- Domestic growth momentum: India’s economic growth, while positive, needs to stay robust to attract foreign investments and boost corporate earnings, driving up stock prices.

- Monsoon performance: A good monsoon is vital for India’s agricultural sector and overall economic well-being. A bountiful harvest can lead to increased rural spending and higher corporate profits, benefiting the market.

- Corporate earnings growth: Ultimately, the Nifty’s performance depends on the earnings growth of the companies it represents. Strong corporate earnings, driven by factors like rising demand and improving margins, will fuel the market’s upward journey.