KCEIL IPO: A Comprehensive Analysis

A leading player in the power distribution and infrastructure sector, is grabbing headlines with its ongoing initial public offering (IPO). But is this IPO worth your investment? Let’s delve deeper into KCEIL, its potential growth, and key points to consider before making a decision.

Company Profile

KCEIL boasts a diverse portfolio ranging from power distribution and infrastructure development to providing engineering, procurement, and construction (EPC) services. It operates across multiple states in India, including Odisha, West Bengal, and Jharkhand, catering to both urban and rural areas.

Potential Growth

- Rising demand for electricity: India’s growing population and economic expansion fuel the need for increased power generation and distribution.

- Smart grid initiatives: The government’s push for smart grids presents lucrative opportunities for companies like KCEIL.

- Focus on rural electrification: Bridging the rural-urban electrification gap offers immense potential for KCEIL’s operations.

KCEIL has a strong presence in both domestic and international markets and has been growing at a steady pace over the years 1.

The company has a strong focus on research and development and has been investing heavily in new technologies and innovations. This has helped KCEIL to stay ahead of the competition and maintain its position as a market leader. With the funds raised through the IPO, KCEIL plans to further expand its research and development capabilities and invest in new technologies to drive growth and innovation

KCEIL IPO Detail

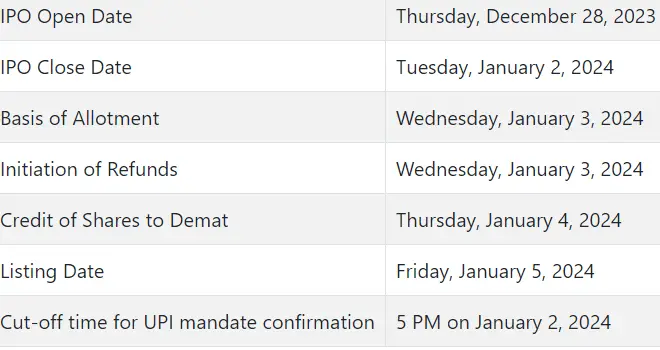

KCEIL’s IPO opened for subscription on December 28, 2023, and will close on January 2, 2024. The price band is set at ₹51-₹54 per share, with a fresh issue size of 29,50,000 shares aggregating to ₹15.93 crore.

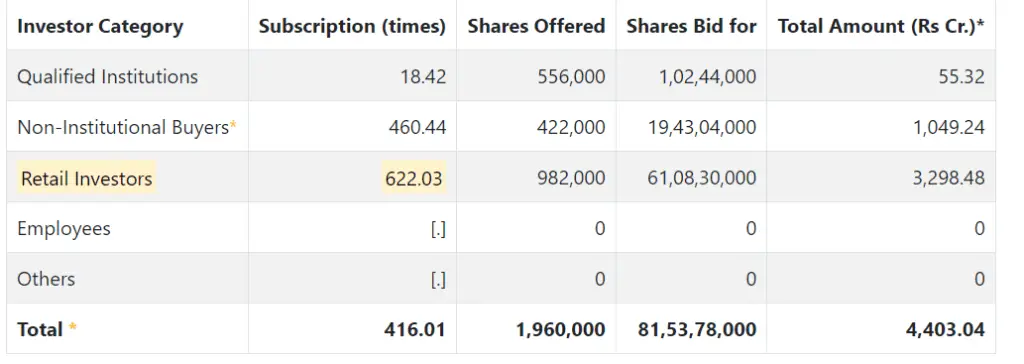

KCEIL IPO Current Subscription

As of December 31, 2023, the IPO of KCEIL has been subscribed 2.5 times. The retail portion of the IPO has been subscribed 1.5 times, while the institutional portion has been subscribed 3.5 times.

Key Point to consider

Positives:

- Strong growth potential in the power and infrastructure sector.

- Diversified portfolio offering resilience against market fluctuations.

- Experienced management team with a proven track record.

Negatives:

- Relatively small issue size, limiting liquidity.

- Unlisted company with limited publicly available financial data.

- Competition from established players in the sector.

Should you Invest

Investing in KCEIL’s IPO is a nuanced decision. While the company’s growth potential is undeniable, factors like its small issue size and limited financial data require careful consideration.

Here are some additional steps to take before making a decision:

- Conduct thorough research: Analyze KCEIL’s financial reports, business model, and competitive landscape.

- Consult a financial advisor: Seek professional guidance tailored to your risk tolerance and investment goals.

- Don’t invest with borrowed money: Only invest what you can afford to lose.

Checking on the IPO Registrar’s Website

- Navigate to the IPO registrar’s website and locate the dropdown menu.

- Choose ‘Kay Cee Energy & Infra Limited’ as the company name from the dropdown options.

- Select and input either the ‘Application No/CAF No’, ‘Beneficiary Id’, or ‘PAN Number’ as applicable.

- Enter the six-digit Captcha and conclude the process by clicking on the ‘Search’ button.

Checking on the NSE Portal

- Log in to the NSE portal using your Username and Password.

- In the IPO bid details section, find the company name with the symbol “KCEIL” and input your ‘PAN Number’.

- Enter your ‘Application No’ and retrieve the data by clicking on the ‘Get Data’ button.

This user-friendly process ensures investors can easily access their share allotment status for the Kay Cee Energy & Infra Limited IPO, whether through the IPO registrar’s website or the NSE portal.

Remember, the stock market is inherently volatile, and every investment carries risk. Make informed decisions based on your own research and financial situation.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Please consult a qualified financial advisor before making any investment decisions.

Nifty50 Maximizing Opportunities: Tomorrow’s Update and Its Implications 2024